Have you ever pondered the optimal timing for starting your investment journey? The answer is quite straightforward: as soon as possible. Initiating investments at an early stage grants greater potential for growth. Understanding the concept of time value of money is crucial for achieving financial success. Here, we present a demonstration highlighting the remarkable influence of time value of money on a portfolio.

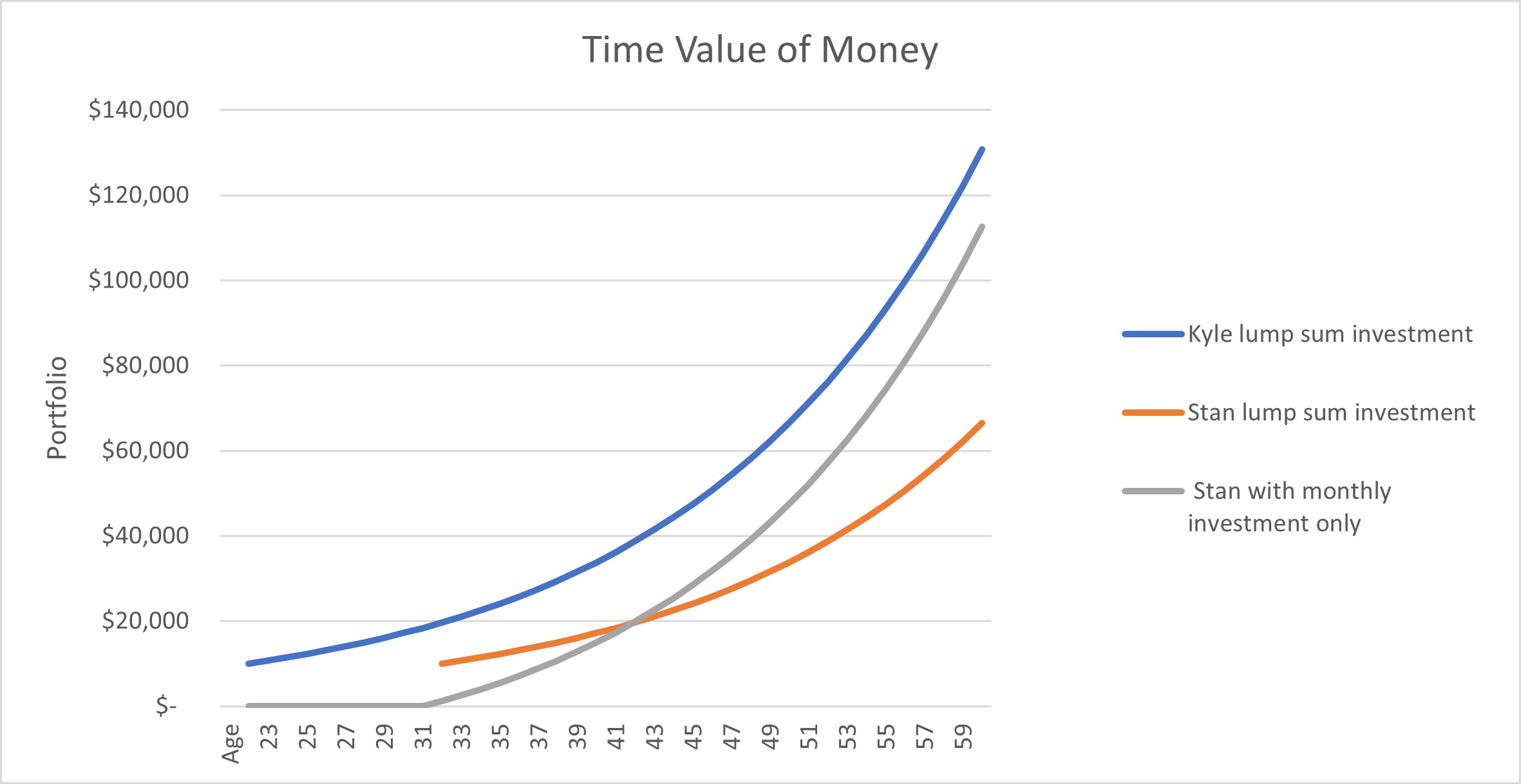

Let’s consider the experiences of two individuals, Kyle and Stan, with different investment approaches. Kyle starts investing as soon as he gets out of college at the age of 22. He begins with a $10,000 lump sum in an investment account and leaves it alone until he is 60 years old. Assuming a 7% growth rate, the investment would grow to $133,793.

On the other hand, Stan, who has been employed for some time after completing his education, hesitates to invest, waiting for the opportune moment. When Stan turns 32, he decides to invest the same amount of $10,000. By the time he is 60 he will have $66,488, assuming the same growth rate of 7%.

Clearly, despite starting a mere 10 years later than Kyle, Stan ends up with only 50% of Kyle’s final amount. This example shows the significance of time horizon in your investment strategy to accomplish long-term financial goals. Compound interest is powerful. It’s the practice of growing your investments over time from reinvesting your total investment returns (market appreciation, interest, dividends and capital gains) to generate additional capital over time. This concept is also called the time value of money.

If you find yourself joining the investment game later, don’t be discouraged. If you are feeling that you don’t have much or can’t accumulate a lump sum to invest, there are other ways you can help yourself catch up. Monthly investing is a great way to get started and to develop the savings habit needed for long term goals. Let’s look back at our example of Kyle and Stan. If Stan were to do everything the same but do a monthly investment of $100 on top of his initial investment at age 60, he would end up with $174,458. That’s a huge difference from the $66,488 he would have had, if he had not made the monthly investments. That’s the power of compounding interest. If you are younger and don’t have a big lump sum to start you off, you can begin with a small monthly investment and if you are consistent, you’ll actually be better off than just letting a lump sum you invested and forgot about grow. If you were to invest $100 a month starting at age 22, at age 60 you would have $243,630 assuming the same 7% average growth rate. That’s over $100,000 more than if you were to just invest a one-time lump sum investment. Another thing to consider is to increase the monthly $100 over time. The more you increase the amount you can save monthly, the more exponentially your assets will grow. The savings habit can become contagious!

To get an approximation of when your money is going to double via compounding interest you can utilize the rule of 72. Simply divide 72 by your average interest rate, and the result will provide an approximate number of years required for your investment to double, assuming no monthly contributions. For instance, assuming your funds are projected to grow at an average rate of 7%, using the rule of 72 suggests that your investment will double in approximately 10 years.

To summarize, stop procrastinating and get started on building your investment habits. There are huge potential benefits to starting early and investing monthly. What you save is the number one thing you can control with your financial plan. Let us review your case and help you navigate how much you need to be doing to accomplish your goals. Without a plan, it’s difficult to get where you want to be.