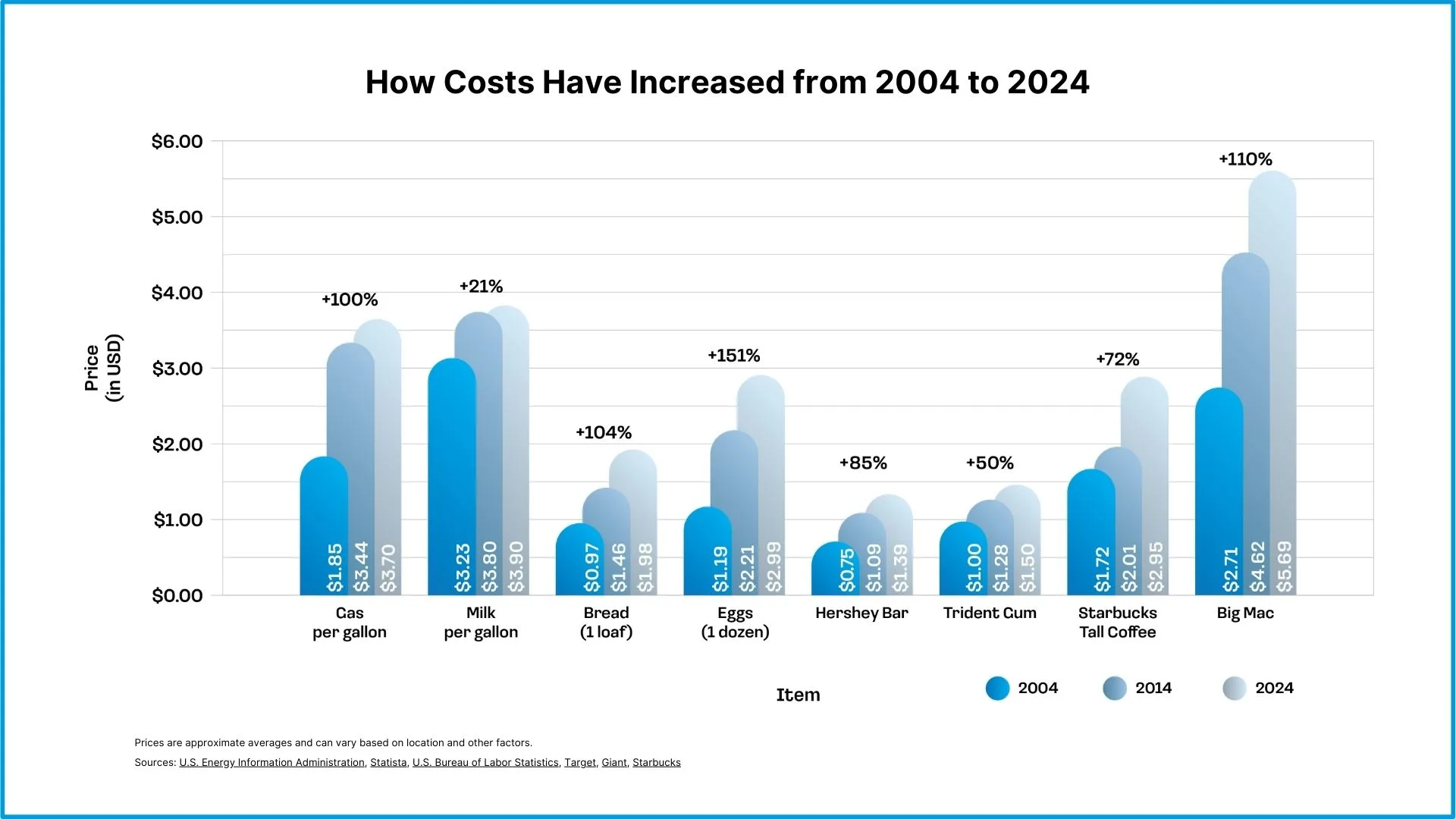

Everything seems to cost more these days. We have seen a recent uptick in inflation, but it’s helpful to get a better long-term perspective on prices, inflation, and the markets. Inflation has spiked recently, capturing everyone’s attention. Over the last 20 years, the prices of gas, bread, eggs, and Big Macs have at least doubled. While this seems significant now, the average annual increase has been in the 2-4% range over the past 10 years and 3-4% over the last 20 years. These numbers are very close to historical inflation averages.

While the focus is on inflation, it’s also important to consider wage increases for workers and market increases for retirees, as expenses are just one side of the equation. How we meet these increased expenses depends on the growth of our income and investments. Let’s first focus on the impact on workers, followed by the impact on retirees.

Wages have grown faster than inflation over the last 10 and 20 years, even if it doesn’t always feel that way. Wages have increased by an average of 4% per year over the last 10 years and 3.4% over the last 20 years. With inflation averaging 3.15% over the last 10 years and 2.77% over the last 20 years, average wages have more than kept up with inflation. Despite recent spikes making it seem otherwise, wages in many jobs have indeed kept pace. However, the cost of buying a home has outpaced wage increases from 2000 to 2023, driven by low interest rates and limited supply. The recent rise in interest rates and high demand have made homeownership challenging, forcing many to relocate or delay buying a home.1

Did retirees keep up with inflation? Social Security, government, and teacher annuities have closely matched inflation rates over time, growing approximately 3% per year.2 Retirees who saved money in retirement plans and invested in diversified portfolios have fared well relative to inflation. The stock market, including dividends, has increased by 9.56% over inflation in the past 10 years and 6.96% over inflation in the past 20 years. Historically, investors have been rewarded for taking additional market risks. As long as companies can raise prices at a pace equal to or greater than inflation and are managed prudently, stocks can be an effective hedge against inflation.

Sources:

1- Current US Inflation Rates: 2000-2024

National Average Wage Index

2- Cost-Of-Living Adjustments

Inflation Chart Sources:

U.S. Energy Information Administration

Statista

U.S. Bureau of Labor Statistics

Target

Giant

Starbucks