Investors generally are very predictable when it comes to investing. They want to invest when markets rise and sell when they fall. They know that with elections, a war, or a crisis, it’s time to do something different. The temptation to try to time markets is so hard to resist. It’s because you are so sure how these events will impact the market, both positively and negatively.

Living through cycles, properly diversified with a reasonable risk level, allows investors to achieve their goals. Therefore, the best time to invest is when it’s the most uncomfortable and volatile. It’s difficult to resist emotional responses to daily events and to keep disciplined with a solid investment approach.

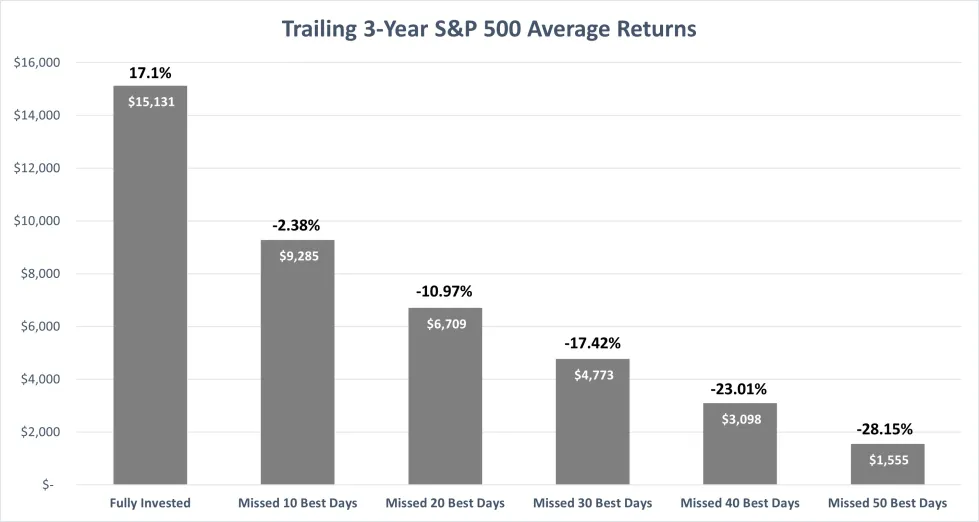

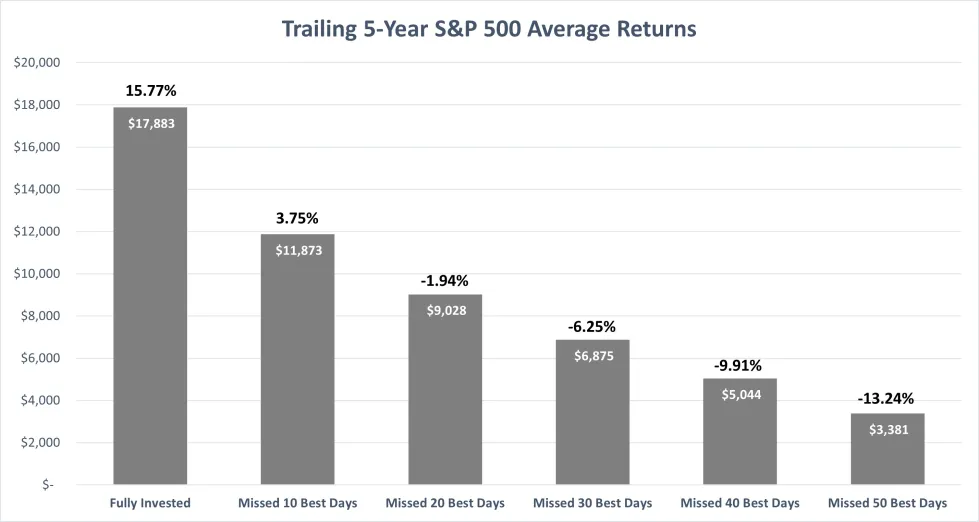

The data supports the idea that the risk of being out of the market leads to lower returns. Market movements are so swift and concentrated that, by missing the best trading days, you can negatively affect your returns.

Let’s look at how your returns are affected by missing the best days in the market over different periods:

February 24, 2021 – February 23, 2022 (Deep In the Trenches, n.d.)

Source: Y-Charts

Source: Y-Charts

Thinking of timing the market now? The odds are stacked against you. It’s better to remain fully diversified and patient during downturns. When you try timing the market, you are more likely to get below-market returns.

While there is always a feeling that you need to do something different, it’s important to resist emotional changes to your investments. Remember that markets are leading indicators and are projecting the recent volatility that portends an increasing likelihood of a recession. Following the latest trend, investing in unregulated markets, and investing in abstract investments add greater risks and increase your chances of not attaining your longer-term goals.