What You Need to Know

On July 18, the IRS issued final regulations on inherited IRAs. To fully understand these changes, it’s important to first look at the history.

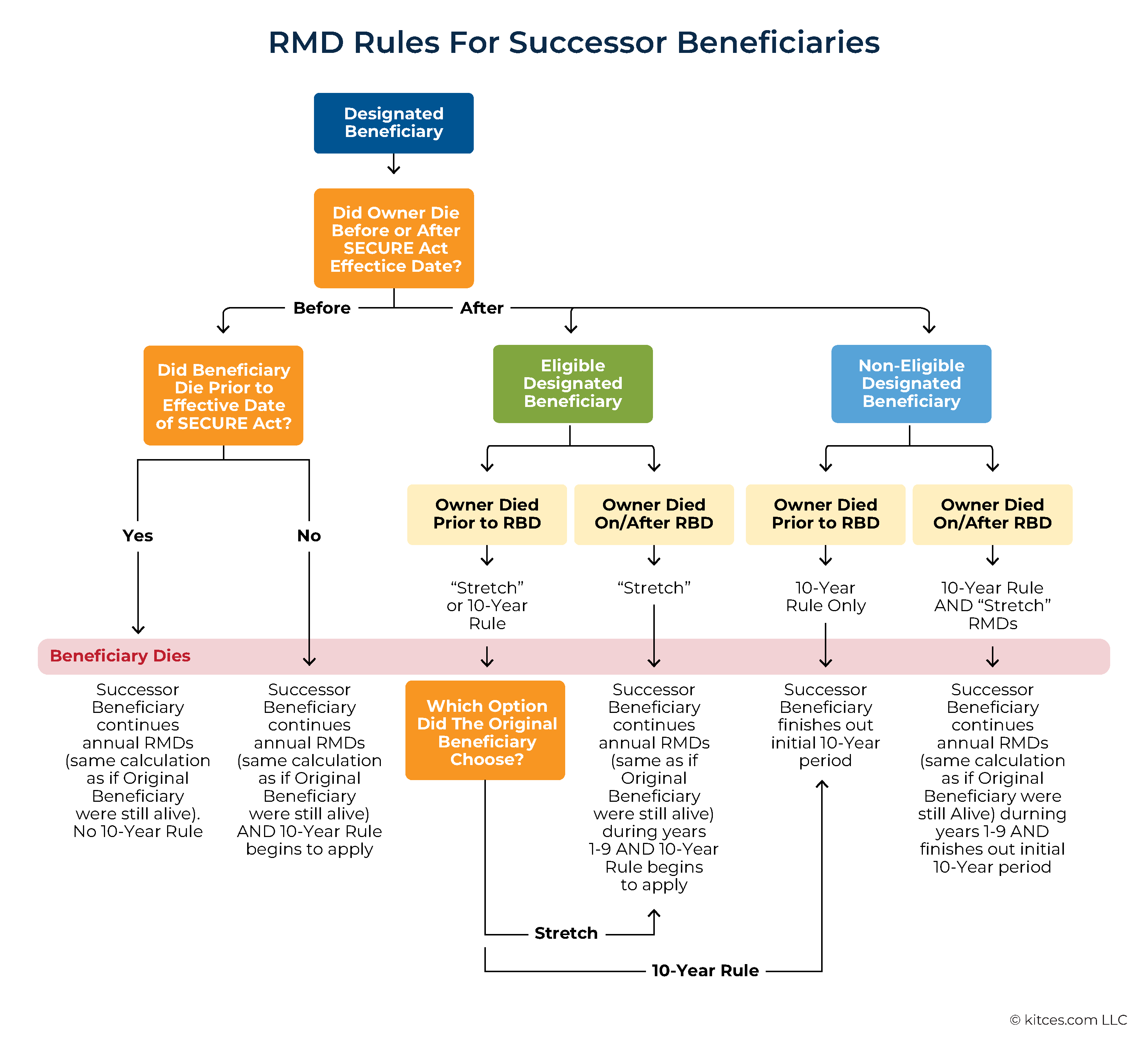

In December 2019, the SECURE Act introduced significant changes to beneficiary IRA distributions. The Act eliminated “stretch” distributions for most non-spouse beneficiaries, requiring them to fully distribute the inherited IRA within 10 years of the IRA owner’s death.

In 2022, the IRS proposed regulations that clarified if the original IRA owner was taking required minimum distributions (RMDs) before their death, the beneficiary would need to continue taking annual RMDs and fully deplete the IRA by the end of the 10th year.

The New Final Regulations:

So, what are the new rules?

- Penalty Relief (2021-2024): If someone was required to take distributions under the regulations from 2021 to 2024 but failed to do so, any penalties are waived.

- Mandatory Distributions Starting in 2025: Beginning in 2025, beneficiaries must take annual RMDs and fully deplete the IRA by the end of the 10th year after the owner’s death, provided the owner died after reaching their RMD start date.

- Exceptions for Certain Beneficiaries: There are exceptions to this rule for “designated beneficiaries,” which include:

a. Surviving spouses (who can treat the IRA as their own)

b. Minor children (until age 21)

c. The chronically ill or disabled

d. Beneficiaries less than 10 years younger than the deceased individual - Death Before RMD Date: If the original IRA owner dies before their required minimum distribution date, the annual RMD rule does not apply, but the account must still be depleted within 10 years.

- Roth IRAs: Roth IRA beneficiaries are also subject to the 10-year rule, but they do not have any annual distribution requirements, and no taxes are due on the withdrawals.

These new rules provide long-awaited guidance on handling inherited IRAs for those passed down after 2019. However, the regulations are complex, and penalties will apply if the RMD requirements are not met. We can help you navigate these new rules and develop a strategy for your withdrawals.