As fall approaches, the United States’ economic engine continues to be resilient. While the focus was on rising rates, now economists and investment managers are expecting rates to normalize and, potentially, fall. Stabilization of interest rates is essential for the marketplace to continue to recover. Employment and earnings results will determine if the Federal Reserve has engineered a soft landing and avoided a recession.

However, amidst this economic backdrop, the country faces challenges on the fiscal front. The deficit is on the rise, and Fitch’s recent downgrade of the US government credit rating from AAA to AA+ has amplified concerns. These developments have given rise to discussions about the potential replacement of the dollar as the world’s primary currency. The situation is further complicated by partisan conflicts and the indictment of a former president, which have eroded confidence in the US political system on an international scale.

While the notion of shifting away from the dollar as the dominant global currency seems unlikely in the immediate future, understanding some fundamental factors is crucial in evaluating this premise.

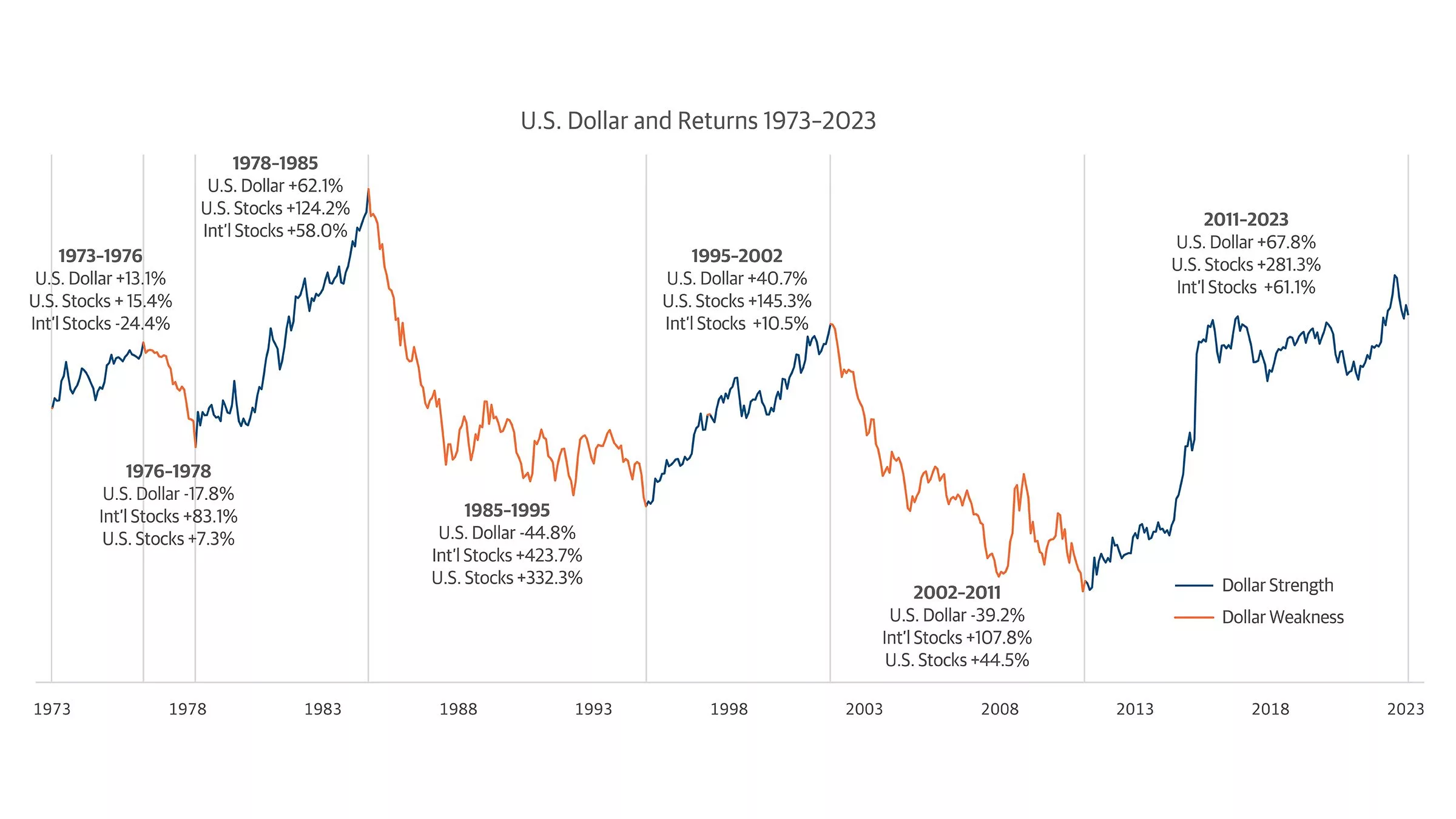

A reserve currency refers to a currency that is held by the world’s central banks in large quantities to facilitate global trade. Currently, the dominant currency is the dollar, but the pound, yen, euro and yuan are also widely utilized. Currencies fluctuate in value relative to other currencies. We have just gone through a cycle from 2011 to 2022 where the dollar has been strong relative to other currencies. However, such trends can indicate that we may be close to the dollar weakening, which is expected, given its cyclical nature. A notable example of this occurred from 1985 to 1995 when the dollar lost 45% of its value.

It’s important to distinguish the weakening of the dollar from its loss of reserve status, as these are distinct occurrences. Despite potential weakening, the dollar’s position as a reserve currency remains intact. Additionally, fluctuations in the dollar’s strength do not necessarily indicate stock market performance, as these are separate aspects subject to different influences.

About half of the international trade is transacted in US dollars and half of the international loans and debts are denominated in dollars. This helps to facilitate global trade and reduce transaction costs. The US dollar is deeply rooted in the world economy. Most people don’t realize that the pound was the primary reserve currency until the dollar replaced it in 1944.

World currency reserves at the end of 2022 have the US Dollar at 58% of all reserves and the Euro accounting for 20%. The pound, yen, yuan, Canadian dollar and Australian dollar make up the balance. China is using the yuan in trade with Brazil and Argentina and hoping to increase its influence around the world. Trade in the yuan accounts for less than 2% of global trade.

The dominance and size of the US economy make it difficult for the dollar to be replaced. The United States makes up 25% of the world’s gross domestic product. 90% of all the global foreign exchange markets are dollar-based. It’s considered to be efficient, well-regulated, and transparent. The ease of use makes it attractive to other countries.

What does this mean as an investor? We don’t know if the dollar’s strong cycle is ending but it does raise several points. First, diversification is key. This means diversifying geographically, by asset class, and by sector. Multinational companies and international stocks can perform well during a weaker dollar environment. Rapid technological advances and business adaptability can outweigh and mitigate the impact of a weakening dollar. Sectors with demand elasticity such as energy, material, technology, and industrials also generally perform well in this type of environment. Our client portfolios have exposure to these areas and are positioned for these changes.

It’s important to validate the source of any information you read to ensure it’s grounded in facts and not a promotion of ideology or newsletters. It’s too easy for misinformation to be disseminated in today’s world.

Sources:

https://www.schwab.com/learn/story/will-us-dollar-be-dethroned

https://www.northwesternmutual.com/life-and-money/will-the-dollar-lose-its-status-as-the-worlds-reserve-currency-probably-not/

https://www.rbcwealthmanagement.com/en-asia/insights/is-the-us-dollar-bull-market-coming-to-an-end#:~:text=We%20can’t%20say%20that,cycle%20is%20established%20in%20earnest