There has been so much talk about the Federal Reserve raising rates and the constant debate about whether we are in a recession. While this subject gets plenty of media attention, the real question is, what does it mean for a long-term investor and how do the markets typically perform in a recession or slower growth economy?

First, we must understand that, technically, a recession occurs when the GDP declines for two consecutive quarters. Recent recessions have occurred in 2001, 2008, and 2020 (although there have been 13 since World War II). The length of recessions, historically, is about 17 months. So, if we have met the criteria, why the debate? So far, employment numbers and earnings contradict the notion of a recession. This past quarter, 78% of company earnings have exceeded expectations. The cause of the GDP declines may relate to a short drop in worker productivity and companies increasing inventories to offset supply chain issues.

The issue at stake is when the Federal Reserve raises rates to erode inflationary pressures is not only due to the short-term effects on the stock market, but it has the potential to significantly impact economic growth. Bottom line, the market is adjusting to new valuations.

It is important to remember that the stock market is a leading indicator. This means we feel the market downside well before the recession starts and the market stabilizes well before the economy recovers. Bear markets are all different in their causes, depth of decline, and length to recovery.

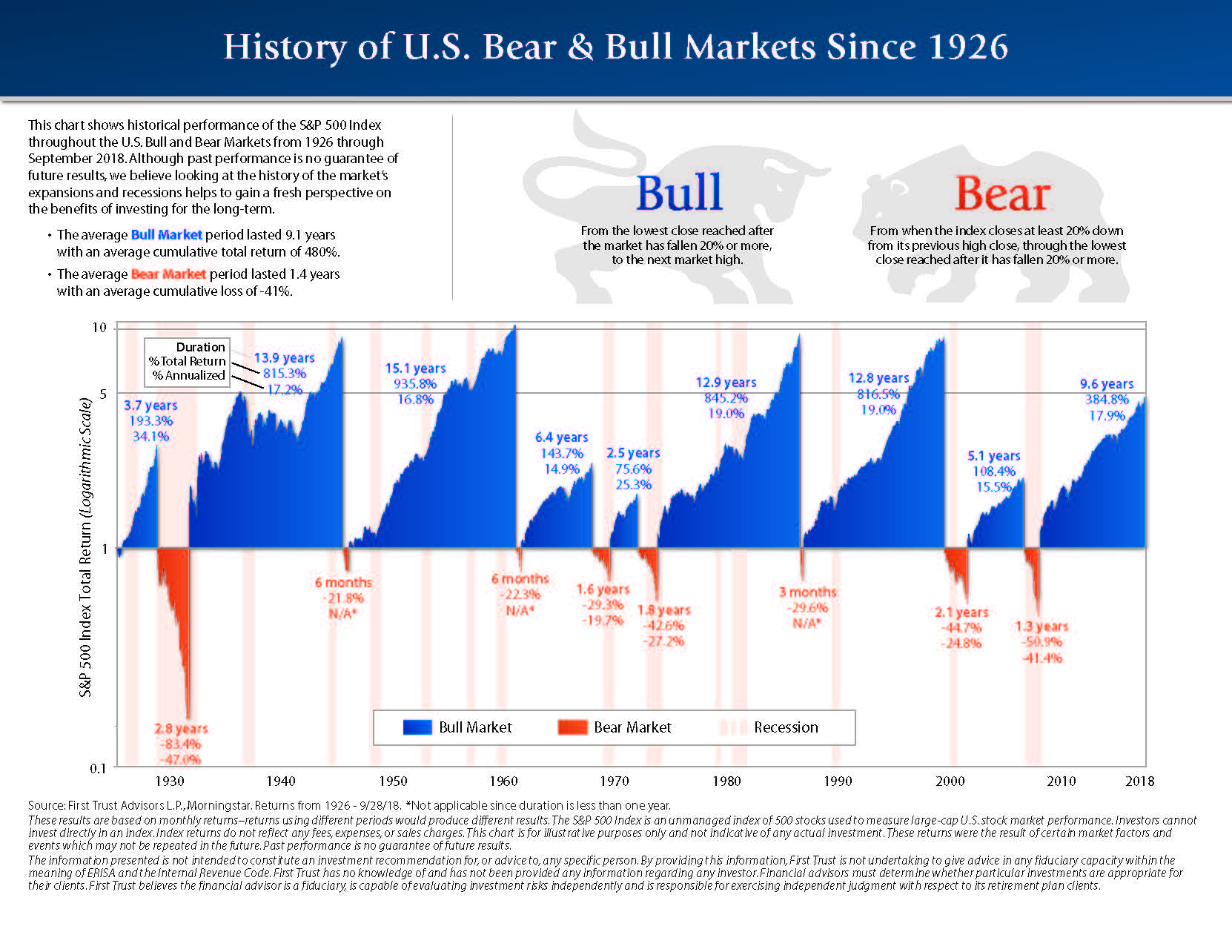

Business cycles are a part of investing. The most telling part of the chart below is that the average bull market lasted 9.1 years with an average cumulative return of 480% and the average bear market lasted 1.4 years with an average cumulative loss of -41% through September 28, 2018. Historically, markets are up more than they are down. This is why our investment philosophy focuses on managing risk by fully diversifying amongst asset classes and industries, and rebalancing investment portfolios.

While no one can accurately predict the future, learning to live with volatility has historically rewarded investors. The real key is to match your objectives with your risk level. Trying to time the market or going with your gut will most likely reduce your longer-term returns. After all, the market does not react to how you feel, it reacts to the financial fundamentals (earnings and dividends) reflected in the daily pricing. Short-term events can increase volatility, but ultimately markets return to financial fundamentals.

No one likes pullbacks but, whether it is recessionary or not, they are a normal part of long-term investing. My previous article on surviving the market helped to guide you on prudent approaches to living through the downturn.