As we approach year-end and move into 2025, here are some important considerations for your planning:

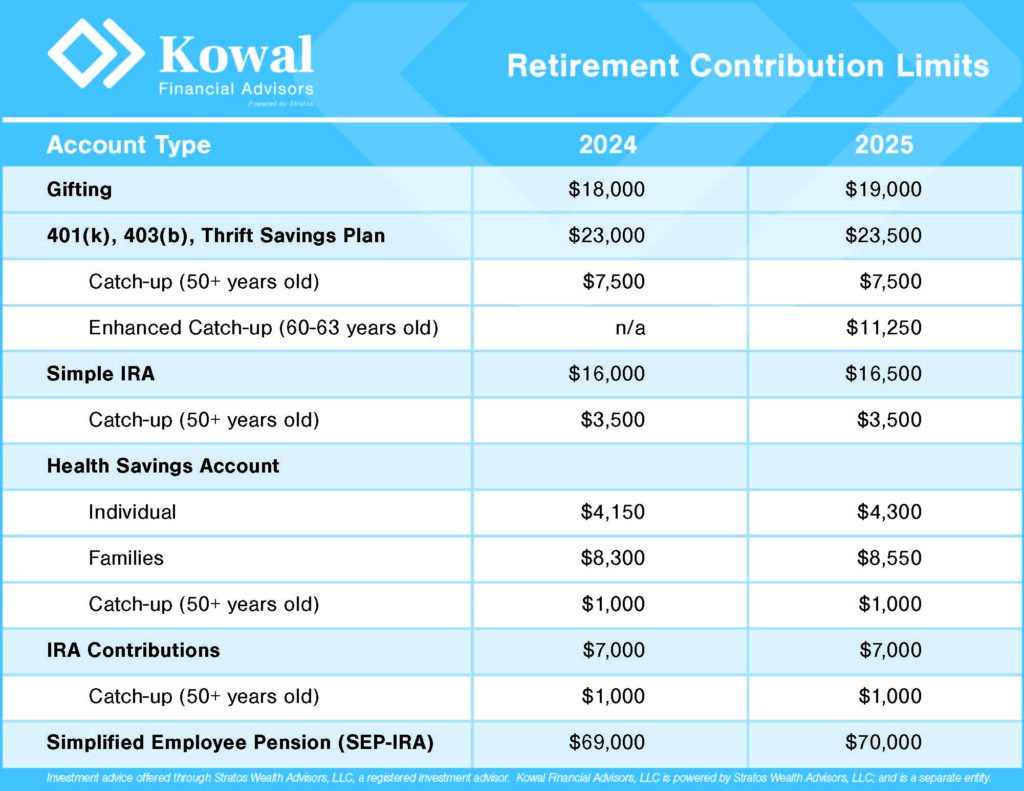

2024 Gifting: Needs to be completed by December 31. The annual exclusion amount is $18,000 per donee (increasing to $19,000 in 2025).

Retirement Plan Contributions:

- 401(k), 403(b), Thrift Savings Plan, and most 457 plans maximum contributions will increase to $23,500, with a catch-up contribution of $7,500 for those aged 50 and older. This puts the total maximum contribution at $31,000 for 2025.

- Enhanced catch-up contributions for individuals aged 60-63 begin in 2025, increasing to $11,250.

SIMPLE IRA contributions will increase to $16,500 in 2025, and the catch-up contribution remains at $3,500 for those aged 50 and older.

Health Savings Accounts (HSA): Contributions will rise to $4,300 for individuals and $8,550 for families in 2025. The catch-up contribution for those aged 50 and older remains at $1,000.

IRA Contributions: Must be made by April 15, 2025, for the 2024 tax year. Contribution limits remain unchanged at $7,000, with a $1,000 catch-up for those aged 50 and older.

Simplified Employee Pension (SEP-IRA) Contributions can be made up until your tax return filing date, including extensions. The maximum contribution for 2025 is $70,000 (up from $69,000 in 2024).

Unused 529 Plans: Unused funds can be rolled into a Roth IRA up to a lifetime limit of $35,000, provided the account has been held for at least 15 years. You can also transfer funds to another 529 plan beneficiary.

Required Minimum Distributions (RMDs): If you turn 73 in 2024 or 2025, you must begin annual distributions.

Beneficiary IRAs: Starting in 2025, annual withdrawals are required within the 10-year window. Penalties have been waived for 2021 to 2024. Exceptions to this rule apply if the deceased passed away before their RMD date.

Review your cash reserves to help ensure they can cover unexpected expenses, short-term needs, or potential employment changes.

Prepare to review your estate documents early next year to help ensure they reflect any changes in circumstances and confirm your beneficiaries are up to date.

Help to Protect yourself against scammers. Run a credit report to check for any unexpected activity. Consider identity protection services and update passwords periodically to help enhance security.

Maintain detailed records for your survivor, executor, or power of attorney to help them access essential documents, photos, and videos when needed.

Revisit your financial planning goals early in the year to implement changes aligned with your short- and long-term objectives.

Sources:

401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000 | Internal Revenue Service

SEP IRA contribution limits for 2024 and 2025 | Fidelity

Families Can Roll Unused 529 Funds to Roth IRAs Starting 2024 | Virginia529

Retirement plan and IRA required minimum distributions FAQs | Internal Revenue Service