2022 has turned out to be a very challenging year. With large interest rate increases, the war in Ukraine, and elections, it has been an extremely volatile and difficult market for diversified portfolios.

As we approach year-end and move into 2023, below is some information for you to consider in planning for next year:

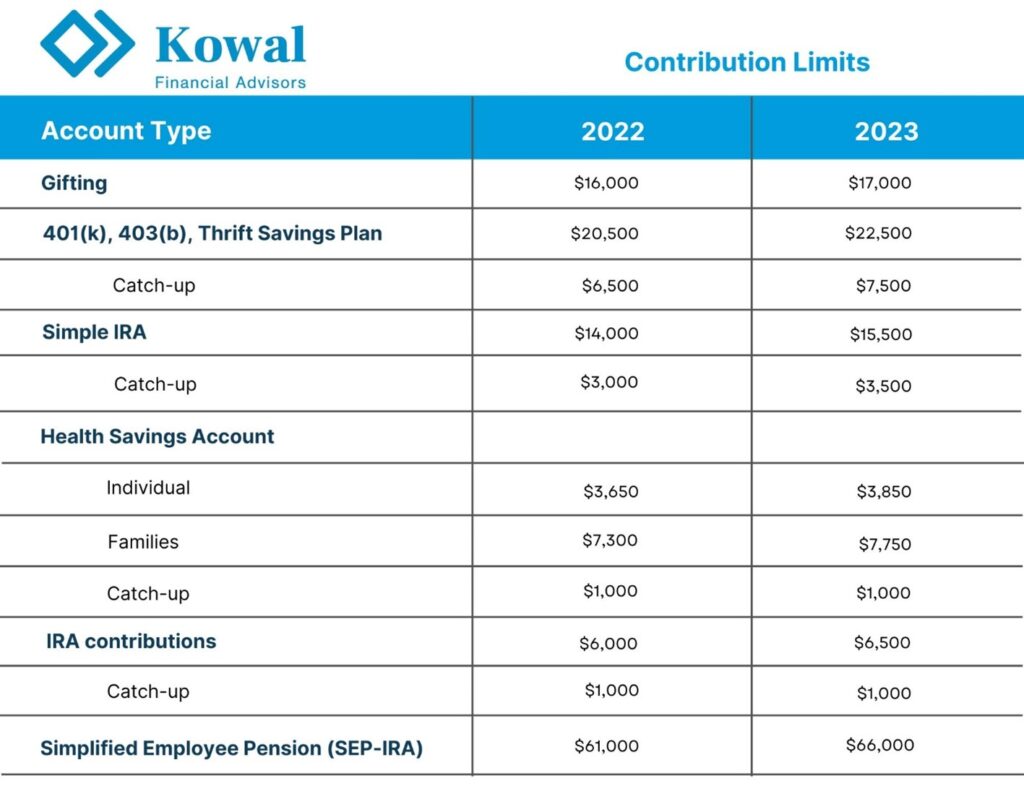

- 2022 Gifting needs to be completed by December 31. The amount that can be gifted under the annual exclusion is $16,000 per donee (this will increase to $17,000 in 2023).

- 401(k), 403(b), Thrift Savings Plan, and most 457 plans maximum contributions will increase from $20,500 to $22,500, and the catch-up contribution for anyone 50-and-over increases from $6,500 to $7,500, putting the maximum total contribution at $30,000 for 2023.

- SIMPLE IRA maximum contribution levels will increase from $14,000 to $15,500 in 2023 and the catch-up contribution for anyone 50 and over increases from $3,000 to $3,500 in 2023.

- Health Savings Account contributions are increasing from $3,650 for individuals and $7,300 for families to $3,850 and $7,750 in 2023. The catch-up remains at $1,000 for 2023.

- IRA contributions must be made by April 15th, 2023 (for 2022). Contribution limits are increasing from $6,000 to $6,500 in 2023, with a $1,000 catch-up contribution for anyone 50 and over.

- Simplified Employee Pension (aka SEP-IRA)contributions can be made up until the filing date of your tax return, including extensions. The contribution maximum for 2023 is capped at $66,000 ($61,000 for 2022).

- Now is a good time to review your cash reserve to make sure you can handle unexpected expenses, shorter-term needs, and potential employment changes.

- Prepare to review your estate documents early next year. Make sure nothing has changed that warrants an update and check your beneficiaries to ensure they are in good order.

- Run a credit report to make sure there is no unexpected activity. Consider getting some identity protection and be vigilant about changing passwords periodically.

Uncertainty and continued economic and geopolitical risks only serve to reinforce our investment strategy of full diversification, managing risk, and rebalancing. Please keep us apprised of any changes. I, along with Jason, Sara and Dale wish everyone a great holiday season. We are looking forward to serving you in 2023 and thank you for your continued support and trust in us.